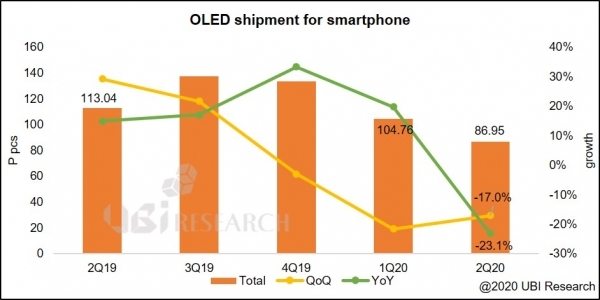

It marks a 23.1 percent decrease from the same period a year earlier and a 17 percent decline from the first quarter of 2020. Decline in shipment resulted from poor shipment of rigid OLED plates. In the second quarter, shipment for rigid OLED panels dropped 40.3 percent year-over-year.

The study states that the decrease in rigid smartphone OLED panel shipments is the result of fewer mid-range smartphones being released in the second quarter of this year from the Chinese brands. The shipments for flexible OLED panels witnessed production, as they concentrated more on flagship-grade products. UBI Research CEO Choong Hoon Yi said at the end of the study that Chinese OLED display technology has advanced and the price of Samsung OLEDs is being sold at 60 per cent. It was due to the Chinese government providing these manufacturers with subsidies to enable them to sell products at low prices.